Swiss Prime Site reports strong results in the first half of 2025 – focus on two pillars is paying off

|

Swiss Prime Site AG / Key word(s): Half Year Results Ad hoc announcement pursuant to Art. 53 LR PRESS RELEASE Zug, 21. August 2025

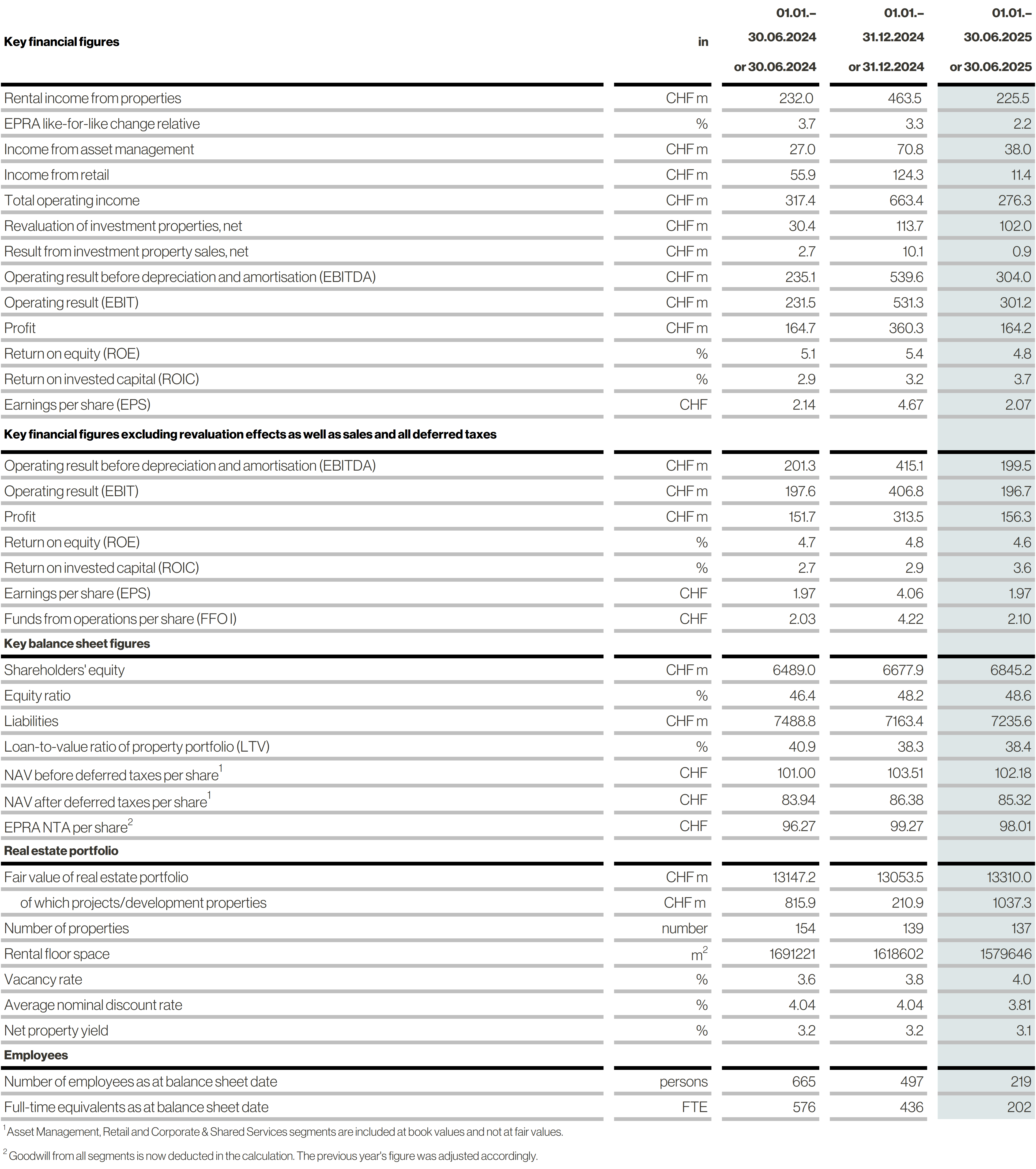

In the first half of 2025, Swiss Prime Site achieved its set targets and laid the foundation for further sustainable and profitable growth. René Zahnd, CEO of Swiss Prime Site: «With the closure of the Jelmoli department store at the end of February, we have opened a new chapter. With our business model now exclusively focused on real estate, we are seeking to seize more growth opportunities as they arise, including in our core business of directly held real estate in major cities and urban areas. Thanks to our broad expertise and deep roots in the market, we are able to acquire attractive properties in prime locations that make a positive contribution to FFO (funds from operations) or dividends per share. This is reflected in the first half of the year, with the significant 3.4% increase in FFO to CHF 2.10 – despite the higher number of shares as a result of the capital increase.» Stable rental income despite numerous construction projects Property portfolio with significant revaluation due to higher net income Following the extensive divestments in the previous year, Swiss Prime Site continued – on a scaled-back level – its strategy of financing development projects by selling non-core properties (capital recycling or upcycling) as it sold six properties for a total of CHF 70 million. This yielded a profit of 4.1% above the last estimated appraisal value. Three of the six property sales have their closing date after the balance sheet date. Asset Management: Jump in profits from capital raises and synergies Operating profit stable, FFO I per share continues to rise Total interest expenses fell for the first time since the cycle turn in interest rates in 2022. For the first half of 2025, they amounted to CHF 27.5 million and were 17% below the previous year. At 0.98% [previous year 1.16%], the average interest rate has returned below the one-percent threshold since some time ago. In addition to interest costs, financial expenses include non-cash fair value adjustments to the last outstanding convertible bond in the amount of CHF 65 million, a direct consequence of the significantly higher share price at the half-year close. Overall, profit before revaluations and sales totalled CHF 156.3 million [CHF 151.7 million]. Capital increase and stable financing structure Interest-bearing financial liabilities excluding leases totalled CHF 5.4 billion as at the balance sheet date [prior year: CHF 5.3 billion]. This financing continues to be drawn from broadly diversified sources on the banking and capital markets. The proportion of unsecured loans rose slightly to 88.1% [year-end: 87.8%], as expiring mortgages were repaid with liquidity and not refinanced. Unutilized, contractually committed credit lines totalled CHF 913 million at mid-year [CHF 1 054 as at year-end], which, together with the unencumbered asset base, guarantees a very high degree of operational and financial flexibility. Confirmation of outlook If you have any questions, please contact: End of Inside Information |

| Language: | English |

| Company: | Swiss Prime Site AG |

| Poststrasse 4a | |

| 6300 Zug | |

| Switzerland | |

| Phone: | +41 (0)58 317 17 17 |

| E-mail: | mladen.tomic@sps.swiss |

| Internet: | www.sps.swiss |

| ISIN: | CH0008038389 |

| Listed: | SIX Swiss Exchange |

| EQS News ID: | 2186718 |

| End of Announcement | EQS News Service |

|

|

2186718 21-Aug-2025 CET/CEST